See, if you’re splitting the quantity variance into mix and yield variances, then there are multiple inputs that can be substituted for each other. Yield variance then is just the traditional quantity variance (i.e. how many finished goods units come from the given input units) adapted to this idea of substitutable inputs. Second, it is more likely that responsibility for overhead costs, even after additional investigation, is spread across several managers and/or departments. That means overhead variances are often less easily actionable than other cost variances. First, overhead absorption is a loose guess (i.e. a PDOH rate, activity-based costing scheme, equivalent units, etc.).

Variable Factory Overhead Variances

For example,if the expenditure is for indirect materials, the credit goes toaccounts payable. If the expenditure is for indirect labor, thecredit goes to wages payable. The credit goes to several different accounts depending on the nature of the expenditure. For example, if the expenditure is for indirect materials, the credit goes to accounts payable. If the expenditure is for indirect labor, the credit goes to wages payable.

Variance Analysis

- Otherwise that variance would get in the way of evaluating performance.

- For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- The variable overhead efficiency variance can be confusing as it may reflect efficiencies or inefficiencies experienced with the base used to apply overhead.

- AP means the “actual price” of the input used to produce the output.

” If it was caused by errors and/or inefficiencies, it cannot be assigned to the inventory. Errors and inefficiencies are never considered to be assets; therefore, the entire amount must be expensed immediately. Let’s say the firm used 10,000 units of input A and 16,000 units of input B and produced 5,000 finished goods units.

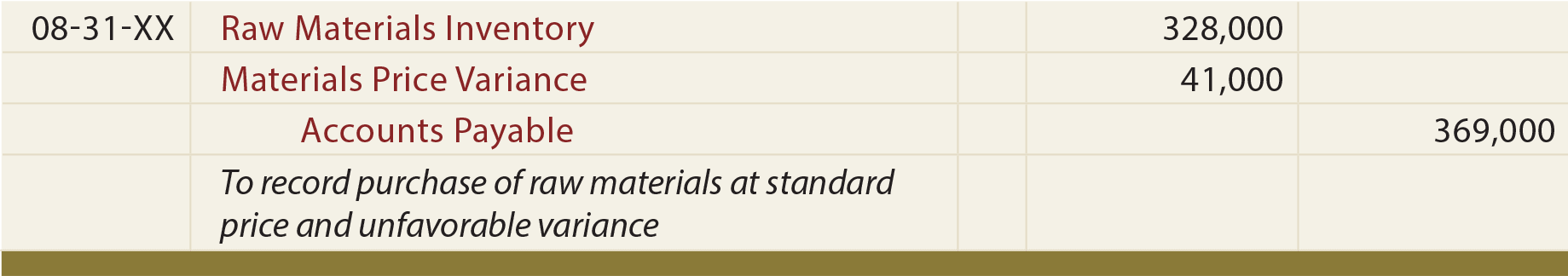

Recording Direct Materials Transactions

As our analysis shows, DenimWorks did not produce the good output efficiently since it used 50 actual direct labor hours instead of the 42 standard direct labor hours. Before looking closer at these variances, it is first necessary to recall that overhead is usually applied based on a predetermined rate, such as $X per direct labor hour. This means that the amount debited to work in process is driven by the overhead application approach. Such variance amounts are generally reported as decreases (unfavorable) or increases (favorable) in income, with the standard cost going to the Work in Process Inventory account. Blue Rail produces handrails, banisters, and similar welded products. This pipe is custom cut and welded into rails like that shown in the accompanying picture.

When forming the budget, variable and fixed overhead are typically added together as total overhead cost. Then, in job-order costing systems, this total overhead cost is used as the numerator to compute a PDOH rate. That is, a PDOH rate usually includes both variable and fixed overhead costs.

( Variable manufacturing overhead variances:

For the remainder of our explanation, we will use a common format for calculating variances. The amounts for each column are computed in the order indicated in the headings. We will pursue the interdependence of variances in the following examples. To find the yield variance, we need to calculate each of the three variables that go into the variance. You can think of the mix variance either as an equation or a table. When I introduced job-order costing in Chapter 4, I simultaneously introduced “normal costing” (from the illustration linked above) even without naming it as such.

It is hard to create a job-order costing example without giving you some sense of how jobs might be assigned overhead costs that, by definition, aren’t being traced directly. This difference is often called the fixed overhead spending variance. In a similar vein the standard quantity is the budgeted cost driver consumption per unit produced. Many firms build these variances into several T-accounts, each bearing the name of the variance they represent.

This is also sometimes called an “efficiency” variance or a “usage” variance. An unfavorable direct materials quantity variance suggests the firm is being inefficient with its direct materials on the production floor. 2021 refund schedule With a little investigative effort, the firm can figure out an action to improve this variance. The exception is when transactions are initially recorded at their standard costs in the accounting records.

So you usually cannot just use the PDOH rate as the standard price of overhead. You have to dig into the budget to find the variable overhead cost rate per unit of the cost driver. When units are moved from the warehouse (or wherever they’re kept) and put into production, your instinct may be to credit the direct materials account for the value of those units and debit the WIP account for the same amount. This $11,500 has to be recorded at actual cost of $11,500 in the wages expense account.